Fed hikes rates by 75 basis points for 2nd straight month | Financial Markets News

Fed policymakers have a tight rope to walk as they struggle to strike a balance between cooling consumer prices and not slowing economic growth.

The Federal Reserve on Wednesday delivered its second-straight 75-basis points interest rate hike as the US central bank doubled down on fighting the highest inflation facing Americans in over 40 years.

Fed Chairman Jerome Powell has previously made it clear that the US central bank is ready to do whatever it takes to fight inflation. He is also expected at an afternoon press conference to signal what the future path of interest rate hikes will look like. The Fed had raised rates by 75 basis points at its June meeting.

US inflation jumped 9.1 percent in June, the largest gain since 1981.

Fed policymakers have a tight rope to walk as they struggle to strike a balance between cooling consumer prices and not slowing economic growth. Fears over a recession are growing among some economists and analysts.

“The Fed will continue to increase the cost of capital for an already slowing economy,” Peter Essele, head of portfolio management at Commonwealth Financial Network, a Massachusetts-based firm, told Al Jazeera.

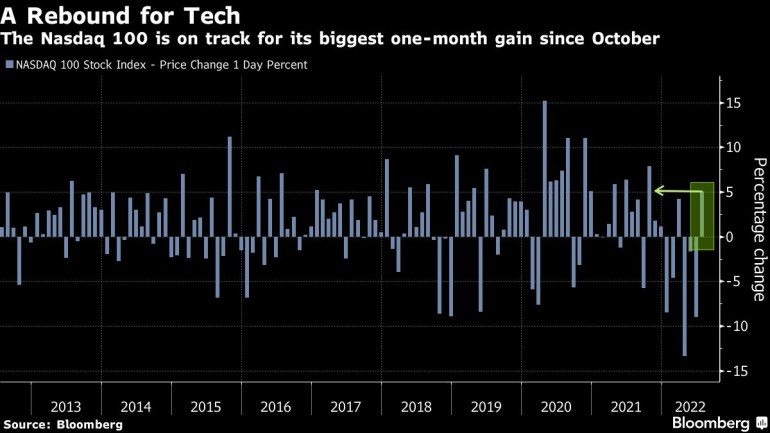

Megacap growth stocks have been hammered this year. The S&P 500, a vital indicator of Wall Street’s confidence, entered a bear market in 2022, having suffered its worst first six months since 1970. Cryptocurrencies have plummeted, with the world’s largest digital coin, Bitcoin, losing more than 55 percent this year.

The pandemic-era housing boom is cooling fast. US pending home sales fell in June by the most since April 2020, according to data released Wednesday.

“Early signs of a cooling effect are most evident in the housing market, a sector that’s been severely impacted by rising mortgage costs,” Essele added.

American shoppers’ sentiment has also taken a major hit in recent months. The Consumer Confidence Index fell for a third month straight to 95.7 from a downwardly revised 98.4 reading in June – the lowest reading since February 2021.

Walmart issued a profit warning on Tuesday, sending its stock down nearly 9 percent and spreading fear that the industry bellwether’s downgrade may be a prediction of what’s to come for the wider retail sector.

But by Wednesday, rosy outlooks from both Microsoft and Alphabet sparked a rally in high-growth stocks.

Microsoft Corp gained 5.01 percent by midmorning after it forecast revenue would grow by double digits this fiscal year. Google’s parent company Alphabet Inc added 5.56 percent on better-than-expected sales.

Amazon.com Inc, Meta Platforms Inc and Apple Inc all gained as well. The tech giants are scheduled to release earnings data later this week.

Recession? Depends on who you ask.

Economists, for the most part, agree that the overall US economy is slowing. But they differ on how deep the slowdown will be.

Some warn that continued Fed tightening and interest rate hikes risk tilting the already-fragile pandemic recovery into a full-blown recession. Others point to a robust labour market – although there are signs that it is slowing – and say that it is difficult to claim a recession when the US unemployment rate is at a historically low 3.6 percent.

The Commerce Department on Thursday will release new gross domestic product (GDP) numbers. Two quarters of growth contraction informally signals that the economy is stuck in a downturn.

But the Biden administration says not necessarily.

“Two negative quarters of GDP growth is not the technical definition of recession,” national economic adviser Brian Deese said during Tuesday’s White House press briefing.

President Joe Biden continues to insist that the economy is in good shape.

“We’re not going to be in a recession, in my view,” Biden said Monday. “My hope is we go from this rapid growth to steady growth.”

Pingback: buy marijuana online

Pingback: สล็อตวอเลท

Pingback: anti stress

Pingback: Japanese models